In the dynamic world of investment, diversification is a cornerstone principle aimed at reducing risk by spreading investments across various asset classes. Among the myriad options available to investors, gold has a place due to its enduring value and stability. Investing the role of gold nuggets in diversifying investments presents a unique opportunity to diversify one’s investment portfolio, combining the intrinsic value of gold with the added allure of owning a piece of natural history.

The Unique Appeal of Gold Nuggets

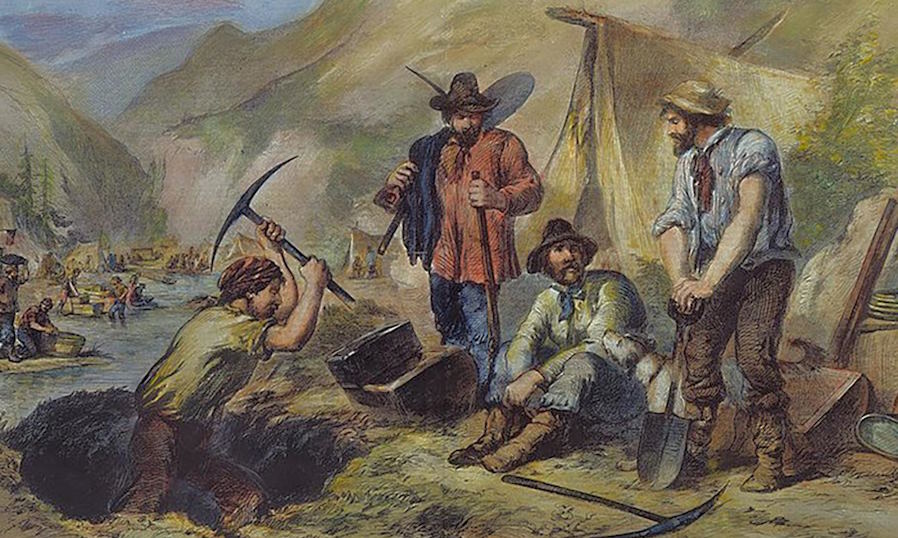

Gold nuggets are rare and naturally occurring pieces of gold that have been eroded from their original host rock and transported by water or geological activity. Their rarity and uniqueness add a premium over the spot price of gold, making them a metal investment but a collectible. The value of a gold nugget is defined by factors that include size, purity, and the specimen, making each nugget a unique asset.

Portfolio Diversification with Gold Nuggets

Adding gold nuggets to an investment portfolio can provide a hedge against inflation and currency devaluation, as the price of gold often moves inversely to the value of fiat currencies. Unlike stocks and bonds, the value of gold nuggets is tied to the stock market or economic policies, providing a haven during financial uncertainty.

Considerations Before Investing

Authenticity and Valuation

Ensuring the authenticity of insight into gold nuggets as an alternative investment avenue as the market can be susceptible to fakes. Investing through reputable dealers and utilising verification methods, such as assaying, can mitigate this risk. Understanding the factors that donate to a nugget’s value, beyond just its weight in gold, is crucial for making informed investment decisions.

Storage and Insurance

Physical assets like gold nuggets require secure storage and insurance, considerations that must factored into the overall investment strategy. Safe deposit boxes or professional storage facilities offer security, while insurance protects against potential loss or theft.

Liquidity

While gold is a liquid asset, the liquidity of individual nuggets can vary based on their size, rarity, and demand among collectors. Investors should consider their liquidity needs and the potential market for their nuggets when counting them into their portfolios.

A Golden Opportunity for Diversification

Investing in gold nuggets offers an attractive option for diversifying an investment portfolio. It combines the inherent value of gold with the unique appeal of owning a tangible piece of natural beauty. By carefully considering the strategic benefits of incorporating gold nuggets in your portfolio authenticity, storage, and liquidity, investors can incorporate gold nuggets into their investment strategy, potentially enhancing returns and providing a buffer against economic volatility. As with any investment, due diligence and a balanced approach are to leveraging the full benefits of investing in gold nuggets for portfolio diversification.